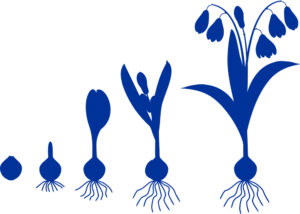

What Are the Five Financial Stages of Life?

May 11, 2022

Many people go through a series of similar financial stages in their life, but unfortunately many of them end up older without having incorporated some of the learning lessons and benefits of previous stages.

Stage one is entering the workforce in early career years. These are the years in which it is hardest for people to save because they may have a lower income amount and may be working towards big goals such as owning a home. However, this is the perfect opportunity to start planning retirement and take advantage of Roth IRA, 403(b), 401(k), and other strategies.

Build your savings and establish a good credit history, obtain disability insurance, and live within your means. And these are the best tips for staying afloat in stage one.

Stage 2

Stage two is your family and career-building years. In this phase, you should focus on purchasing health insurance, buying life insurance, updating your disability insurance as needed, reviewing your estate plan, saving for your child college education, and start growing your career or business further.

Stage 3

Stage three are the pre-retirement years, which ideally should put you in a position to be soon done with paying off your mortgage and other debts. You also want to approach this phase of your life, hopefully able to help support children’s college expenses without taking out additional loans.

If you haven’t done so to this point, this is a good time for you to start a business, and the phase in which retirement planning becomes much more serious.

Stage 4

Stage four is in your early retirement years, which is when you should pin down your actual potential expenses during retirement. Look carefully at what you’ll actually be able to spend monthly at a whole different point in your life. You may also consider how you’ll leave other assets behind for your loved ones during this time as well. This is for your later retirement years, which is your opportunity to continue optimizing taxes. You might even be thinking about changes you can make with ownership of your assets, such as selling them to make way for other goals.

Stage 5

Limiting your overall tax liability in later retirement years is an important strategy to discuss with a financial professional. During this last phase, you should also continue to update your estate plan on a regular basis, and any time that you acquire or get rid of new assets. Following all of these tips can help you to accomplish your top goals as it relates to planning ahead for your own financial future. Do not hesitate to contact an experienced attorney to discuss your next steps.