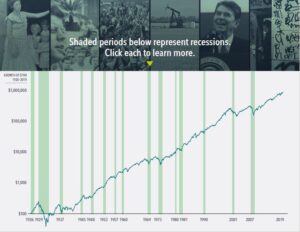

Market Returns Through a Century of Recessions

September 10, 2020

What does a century of economic cycles teach investors about investing? Our interactive exhibit examines how stocks have behaved during US economic downturns. Markets around the world have often rewarded investors even when economic activity has slowed. This is an important lesson on the forward-looking nature of markets, highlighting how current market prices reflect market participants’ collective expectations for the future.

1926—1927

A few years before the Depression, the US experienced a mild, yearlong recession accompanied by a minor bout of deflation. The stock market slipped 2.9% in the first month of the downturn.

Great Depression

The Depression decimated the US economy—unemployment climbed to 25.2%, and industrial production plunged 48.6%. Before the collapse ended, stocks collectively lost 83.6% in a 33-month market downturn.

1937—1938

A sharp, 13-month recession—marked by high unemployment and a big dip in industrial production—occurred in the midst of the nation’s recovery from the Depression. Stock market investors suffered a 49.2% loss.

World War II Recession

Industrial production plunged 26% during the eight-month recession near the end of World War II. But the stock market dipped only 3.9% early in the recession before rebounding.

1948—1949

A modest stock market slide (—11.0%) began five months before this relatively small economic

1953—1954

The Korean Armistice was signed in the summer of 1953. A stock market slump that had begun in March was over by August, but the recession continued until early 1954.

1957—1958

A huge drop in industrial production (–11.3%) and a contraction in GDP (–3%) interrupted the 1950s boom. Stocks retrenched 14.9% in the midst of a decade-long climb.

1960—1961

This four-month pause followed the previous decade’s bull market. In the election year of 1960, unemployment rose to 6.6%, and the stock market dropped 7.9%.

1969—1970

High inflation and a big jump in unemployment punctuated the 11-month recession that began in December 1969. A volatile

Oil Crisis

Inflation hit double digits during the 1973–75 recession. The stock market lost nearly half its value in the first 11 months of the 16-month economic downturn.

1980

A 12% stock market decline occurred early in 1980’s six-month recession, during which unemployment hit 7.6%. But the market finished the year with an impressive gain of 33.4%.

1981–1982

Historically high interest rates preceded a harsh recession that dragged on for 16 months and saw unemployment peak at 10.4%. The stock market experienced a 15.9% slide before beginning a long rally.

Gulf War

Stocks reacted negatively to the onset of the Gulf War in August 1990, dropping 17% over five months as the price of oil doubled. When the market regained its footing, stocks were set to start a nine-year bull market that peaked in the dot-com era.

Tech Boom and Bust

Many investors may not realize that the stock market had started a deep decline before the relatively mild

Global Financial Crisis

During the Global Financial Crisis, the worst of the 50.4% stock market dive happened in the latter half of an 18-month recession that saw unemployment hit 9.4% and industrial production tumble 17%. But after falling for 16 months, the market started a nearly 11-year bull run.

Sources: Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.