Tax Planning with Charitable Trusts (Lead vs. Remainder Trusts): A Guide

April 10, 2024

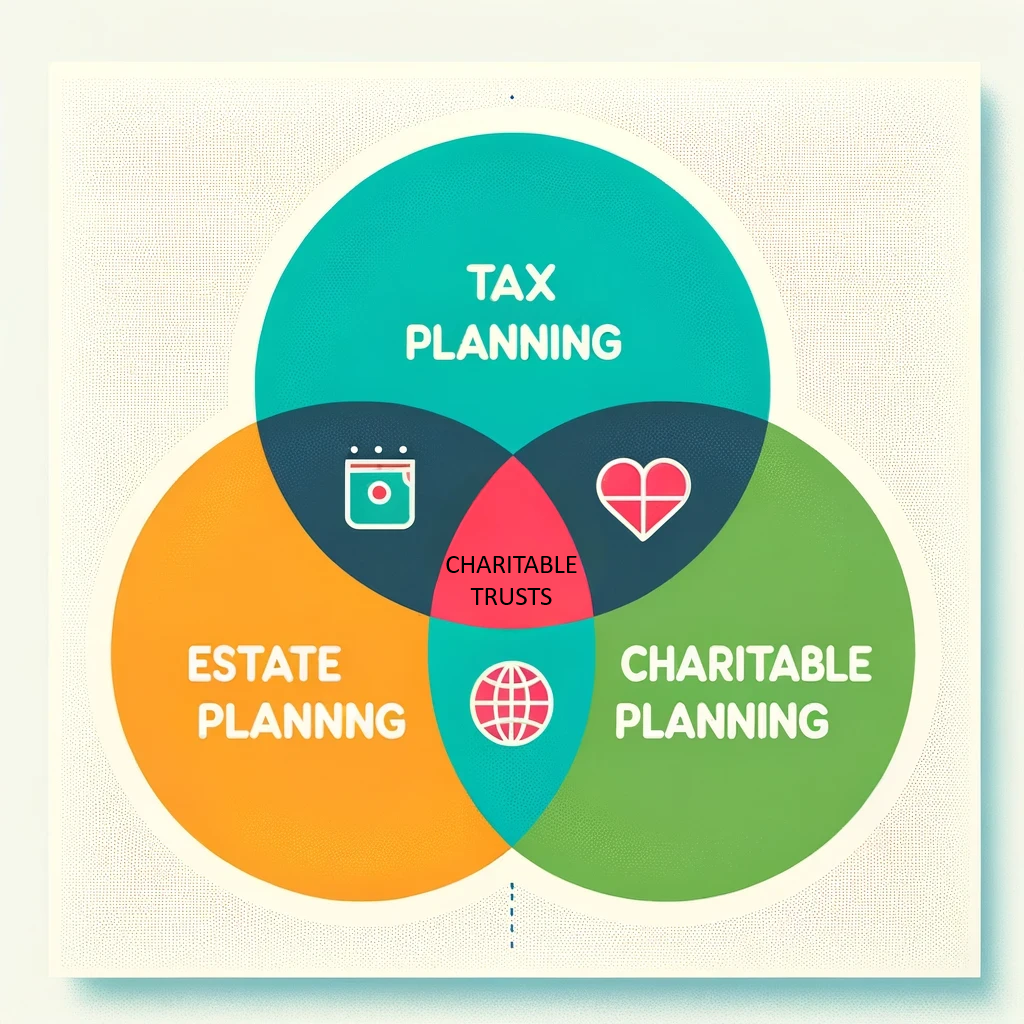

When navigating the complex world of estate planning, financial planning, and tax planning, understanding the tools available to you can significantly impact your philanthropic goals and financial legacy. Two such tools, charitable lead trusts (CLTs) and charitable remainder trusts (CRTs), offer unique benefits and serve different purposes in your wealth strategy. At Omni 360 Advisors LLC, we specialize in demystifying these options to align with your financial and philanthropic objectives.

Charitable Lead Trusts (CLTs) are designed to provide a fixed or variable income to a charitable organization for a set period, after which the remaining assets are transferred to non-charitable beneficiaries, such as family members. This approach not only supports your chosen charity but also can reduce estate and gift taxes, making it an excellent tool for estate planning. CLTs are particularly beneficial for individuals looking to reduce their taxable estate and provide for their heirs in a tax-efficient manner.

An essential distinction between CLTs and CRTs lies in the timing of the tax deduction. With a Charitable Lead Trust, the tax deduction is calculated at the time of the trust’s creation, based on the present value of the income stream that will go to the charity. This means that the deduction is taken upfront, even though the charity receives its benefits over time. Conversely, Charitable Remainder Trusts allow the donor to receive a tax deduction in the year the trust is funded, based on the remainder interest that is expected to go to the charity in the future. This immediate deduction can be particularly advantageous for reducing current income taxes while still planning for future philanthropic contributions.

On the flip side, Charitable Remainder Trusts (CRTs) serve the dual purpose of offering you or your designated beneficiaries a stream of income for life or a specified term of years, with the remainder of the trust going to one or more charitable organizations. CRTs can provide significant income tax benefits, such as an immediate charitable deduction and potential savings on capital gains taxes when funding the trust with appreciated assets. This makes CRTs a valuable component of both financial and tax planning strategies, especially for those seeking to convert highly appreciated assets into a lifelong income stream while supporting charitable causes.

At Omni 360 Advisors LLC, our legal, tax, and advisory team understands the intricacies of these charitable planning tools and is dedicated to helping you identify which option best aligns with your financial goals, estate planning needs, and philanthropic desires. Whether your focus is on maximizing tax benefits, preserving wealth for future generations, or supporting cherished causes, our experts are here to guide you through the decision-making process. Contact us today to explore how CLTs, CRTs, or other estate planning instruments can enhance your financial strategy while making a lasting impact on the causes you care about.