What History Tells Us About US Presidential Elections and the Market

October 1, 2020

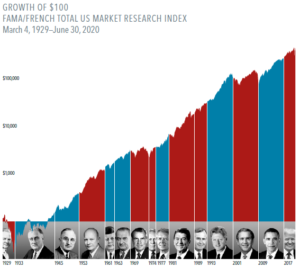

It’s natural for investors to look for a connection between who

wins the White House and which way stocks will go. But as

nearly a century of returns shows, stocks have trended upward

across administrations from both parties.

• Shareholders are investing in companies, not a political

party. And companies focus on serving their customers

and growing their businesses, regardless of who is in the

White House.

• US presidents may have an impact on market returns,

but so do hundreds, if not thousands, of other factors—the

actions of foreign leaders, a global pandemic, interest rate

changes, rising and falling oil prices, and technological

advances, just to name a few.

Stocks have rewarded disciplined investors for decades,

through Democratic and Republican presidencies.

It’s an important lesson on the benefits of a long-term

investment approach.

Sources: Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.