Digital Assets: Essential Steps for Estate and Legacy Planning

August 6, 2025

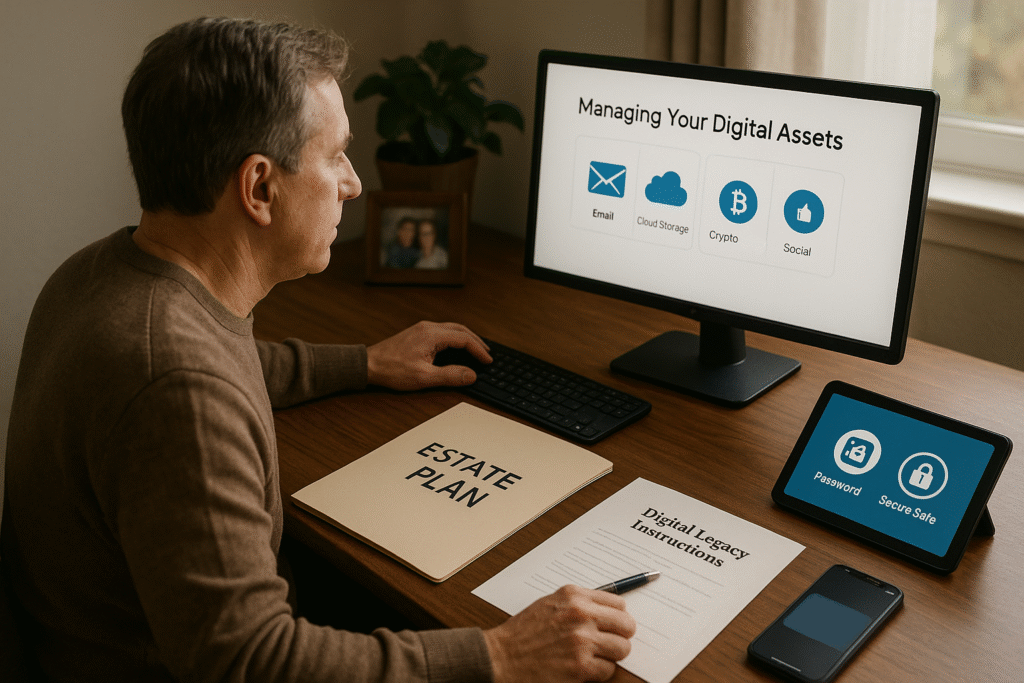

Learn key strategies to effectively manage your digital assets and ensure seamless estate planning for your family and fiduciaries.

Managing Your Digital Assets: Essential Steps for Estate and Legacy Planning

In today’s digital-first world, many of the most valued assets in our lives exist not just physically, but virtually. From treasured family photos and social media accounts to financial rewards and cryptocurrency, digital assets hold significant emotional and monetary value. But what happens to these digital possessions when you pass away?

Here’s what business owners, high-net-worth individuals, and legacy-focused families need to know about managing their digital assets effectively.

Understanding Digital Assets

Digital assets encompass everything from sentimental family videos and photographs stored online to financial assets like cryptocurrency, blogs generating income, or loyalty points from credit cards and airlines. Surprisingly, an average person holds approximately $35,000 worth of digital assets, a figure that’s likely much higher now with the prevalence of virtual property and NFTs.

Why Digital Assets Require Special Attention

Traditional estate planning clearly defines how tangible property and financial accounts are distributed. However, digital assets are governed differently, often creating confusion and potential loss without proper management. Many custodians, such as Google or Apple, have specific rules about what happens to your digital data upon death, complicating access for your fiduciaries and beneficiaries.

Navigating the Legal Landscape

To address these issues, the Revised Fiduciary Access to Digital Assets Act was developed, adopted in some form by most states, to standardize how fiduciaries can access digital accounts. This act enables fiduciaries (such as trustees or personal representatives) to manage digital assets similarly to physical assets, providing legal clarity and protection.

Three Essential Steps to Protect Your Digital Legacy

- Utilize Online Management Tools

Many platforms offer built-in tools to specify what happens to your account after inactivity

or death. For instance, Google’s Inactive Account Manager allows you to designate trusted

contacts to access your data after a period of inactivity. Apple’s Digital Legacy similarly

allows chosen individuals access to essential iOS data. These online directives take

precedence over traditional estate documents. - Update Your Estate Documents

Where no online tool is available, clearly defined instructions in your will, trust, or power of

attorney are essential. Explicitly stating your intentions regarding your digital assets

ensures your fiduciaries have legal standing to manage these accounts, overriding any

contrary terms of service from online custodians. - Maintain an Inventory of Digital Assets

Keeping a comprehensive, secure list of all digital assets—along with usernames,

passwords, and recovery instructions—is crucial. Tools like LastPass or SecureSafe can aid

this process. Alternatively, regularly updated documents stored securely can ensure no

digital asset is overlooked during estate management.

Act Now to Secure Your Digital Legacy

Effectively managing digital assets isn’t just about financial value; it’s about safeguarding your legacy, ensuring peace of mind, and providing clear guidance to those you trust.

At Omni Legacy Law and Omni 360 Advisors, we specialize in comprehensive estate and digital asset planning, tailored specifically to the unique needs of our clients. Don’t leave your digital legacy to chance.

Schedule a strategy meeting with Omni 360 Advisors or book a personalized estate plan review with Omni Legacy Law today.

For more detailed information on digital assets, explore the full guide here.