Give Serious Consideration to End of Life Decisions

November 21, 2013

One major part of estate planning is determining what kind of care, if any, you would like to receive at the end of your life. Although most people would rather not think about the end of their life, a recent article explains the importance of giving serious consideration to end-of-life care.

If you have thought about what type of care, if any, you would like to receive at the end of your life, it is important to complete an advanced medical directive and a medical power of attorney. These documents will allow you to put these desires in writing so that medical staff will be aware of your wishes when you cannot otherwise communicate with them. Additionally, they allow you to select the person who you trust to make medical decisions on your behalf.

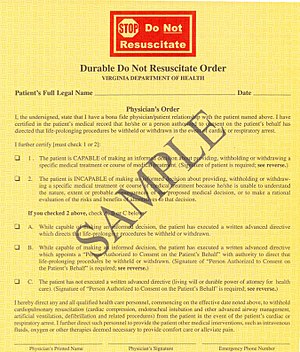

One common type of advanced directive is a do not resuscitate order (“DNR”). A DNR advises medical staff not to take life-saving measures in the event that death is imminent. If you have a DNR, it is important to keep it in an easily accessible location, and inform your family and doctors of its existence. Importantly, an advanced directive that directs medical staff not to prolong the dying process does not withhold medicine and other procedures meant to keep you comfortable during the dying process.

Conversely, you could also complete a prolonging procedure declaration. This document instructs medical staff to do everything they can to delay death, even when it is imminent.