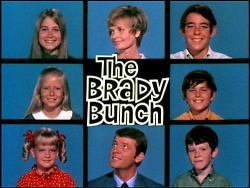

“Here’s a Story…Of a Lovely Lady…” Planning for Today’s Blended Families

June 28, 2012

I grew up watching the Brady Bunch. Mike and Carol Brady are my first recollection of the “Blended Family.” Mike had three children from a previous marriage: Greg, Peter and Bobby (of course, they also had Tiger, the family dog.) Carol had three daughters from her previous marriage: Marsha, Jan and Cindy … the youngest one in curls. Although the concept may have been very progressive & I found the show very entertaining, I have my doubts about how representative or realistic it is of Blended Families that exist today.

For example, wouldn’t it be more likely in today’s age that Mike’s and/or Carol’s divorces would have led to the creation of their new blended family (as opposed to them both being widowed?) I suppose that the producers of the show felt that having Mike’s or Carol’s divorced spouse written into the show would have changed the dynamic (if so, I have to agree.)

Also, what if Mike and Carol had more children after they were married? This new child would be the only common biological child to both parents. How would that have affected the family?

A quick Google search revealed this as a definition for a Blended Family (from this Boston College website):

“1. A family that is formed when separate families are united by marriage or other circumstance; a stepfamily.

2. Various kinship or nonkinship groups whose members reside together and assume traditional family roles” (Barker, 2003, p. 46).

“…has a role structure in which at least one parent has been previously married and which includes children from one or both of these marriages” (Johnson, 2000, p. 119).

My colleague, Jennifer L. Moccia, has written a wonderful blog post with some introductory thoughts on the topic, titled Estate Planning Considerations for Blended Families. Ms. Moccia notes some of the issues surrounding these “nontraditional” families, including:

- the fear that children from a prior relationship may not be provided for by the surviving spouse if the parent were to become disabled or pass away,

- how the absence of an estate plan & a marital agreement may affect a child’s inheritance because of state law,

- who would control the child’s inheritance in the case of a minor child, and

- how to accomplish the parents desires to treat children equally or unequally.

You can read the entire blog post by clicking here. I think the following quote from her post puts it best: “Successful blended family estate planning is a matter of setting and communicating goals, learning the available legal strategies, implementing the chosen documents and setting appropriate expectations for the client. With guidance from experienced counsel, the various goals of each family can be met by crafting and implementing estate plans that provide for each spouse and protect the interests of their respective children.”