When Is the Right Time to Start Business Exit Planning? A Strategic Roadmap for Business Owners

August 7, 2025

Learn why the best time to start exit planning is now—discover key milestones, timelines, and tax-smart strategies to maximize your eventual sale.

“How far out should I be thinking about selling?” is the first question I hear whenever a founder whispers the word exit. The short answer? Yesterday. The long answer—and the one that protects your life’s work and your family’s balance sheet—begins below. Exit planning isn’t a frantic sprint the year you list your company; it’s a disciplined, multi-year process that positions you to choose when and how you leave on your terms.

“The best time to plant a tree was 20 years ago. The second-best time is now.”

1. The Myth of the “Perfect” Moment

Many entrepreneurs wait for crystal-clear market signals: record valuations, a blockbuster

offer, or the day they “feel ready.” In reality, the perfect moment rarely announces itself.

Waiting for certainty often means reacting rather than leading—and leaving money (and

legacy) on the table.

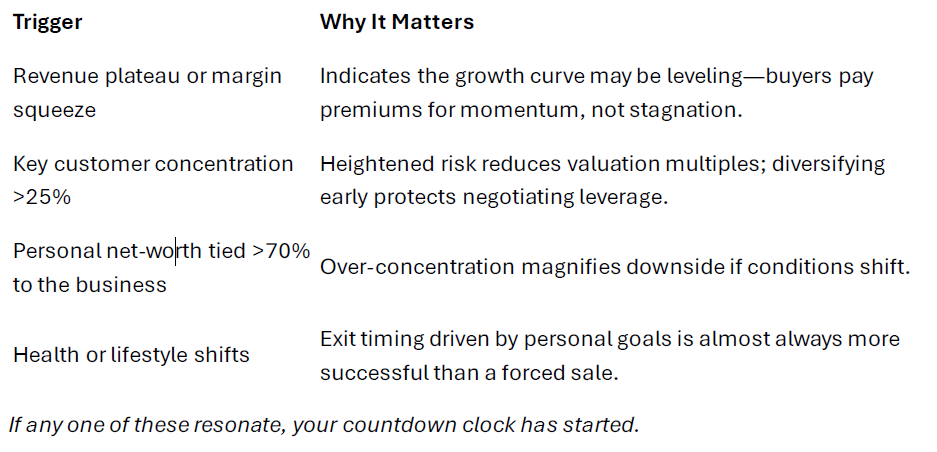

2. Trigger Points That Signal It’s Time to Plan

3. Benefits of Early Exit Planning

- Tax Alpha – Advanced structuring—ranging from QSBS qualification and opportunity

zones to installment sales, strategic charitable planning (e.g., donor-advised funds

or charitable remainder trusts), and harvesting pre-tax losses inside separately

managed accounts (SMAs)—requires a five-year runway to unlock seven-figure

savings. - Operational Clean-Up – Recasting financials, documenting processes, and

unwinding “founder shortcuts” boosts EBITDA multiples. - Succession & Legacy – Grooming leadership and clarifying estate plans ensures

your business—and family harmony—outlast you.

4. A Three-Phase Timeline

- 5 Years Out – Architect

o Benchmark valuation drivers in your industry.

o Implement tax-efficient entity structures and begin estate-freeze techniques.

o Develop an owner-independent management team. - 3 Years Out – Optimize

o Trim unprofitable product lines.

o Negotiate longer-term vendor and customer contracts to lock in recurring

revenue.

o Formalize KPIs and reporting dashboards buyers expect. - 1 Year Out – Showcase

o Commission a sell-side quality-of-earnings report to pre-empt buyer

diligence.

o Polish your growth story with defensible projections and case studies.

o Assemble your deal “A-Team”: M&A advisor, tax counsel, and estate attorney.

5. Common Pitfalls to Avoid

- Over-reliance on a single buyer. Create competitive tension to maximize price and

terms. - Ignoring personal readiness. A lucrative offer feels hollow if you have no post-exit

purpose or wealth blueprint. - One-size-fits-all structures. ESOPs, third-party sales, and family transitions each

carry distinct tax and control trade-offs.

Next Steps: Turn Planning into Action

The ideal exit isn’t an event—it’s the culmination of deliberate strategy. Whether you

envision cashing out to pursue your next venture, funding a family foundation, or simply

reclaiming your weekends, intentional planning today multiplies your options tomorrow.Zx

Ready to design an exit on your own timetable?

- Schedule a confidential strategy meeting with Omni 360 Advisors to map your

personal and corporate readiness. - Book a legacy or estate plan review with Omni Legacy Law to align tax, trust,

and succession pieces before you sign on the dotted line.

Your future buyer will do their homework. Make sure you do yours—well before the ink

meets the page.