Dealing with Early-Stage Alzheimer’s

October 23, 2013

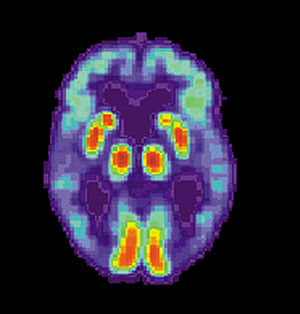

Currently, the sixth leading cause of death in the United States is Alzheimer’s disease. Between 2000 and 2010, the number of deaths caused by Alzheimer’s disease increased by 68 percent. By 2050, the number of Americans with Alzheimer’s disease is set to increase to 13.8 million. As a recent article explains, Alzheimer’s could quite possibly become an epidemic, if it is not one already.

If a loved one in your family begins to display the signs of Alzheimer’s disease, the first thing a family should do (beyond medical attention) is be sure that the family member has executed a will, durable financial power of attorney, and health care power of attorney. These documents allow the person to direct how his or her assets will be distributed upon his or her death, and also to direct who should make medical and financial decisions for him or her when he or she is no longer capable.

Importantly, a person diagnosed with early-stage Alzheimer’s may still be able to sign these legal documents. When a loved one is suffering from short-term memory or vocabulary loss, but still has a grasp on reality, he or she can often show the necessary mental capacity to create legal documents. Although it is best if these documents are created prior to the early-stage dementia, if that is not possible, have a geriatric psychologist evaluate the person immediately prior to signing.