What Is an ID.me Account—and Why Business Owners and Families Should Consider Having One

February 16, 2026

Learn what an ID.me account is, how it works, why it can simplify access to government services, and how to set one up securely. An educational guide for business owners and families.

What Is an ID.me Account?

In today’s digital world, verifying your identity online is increasingly necessary—especially when accessing government services. ID.me is a secure digital identity platform that allows individuals to verify their identity once and use that verification to access participating government agencies and certain private-sector services.

Federal and state agencies—including the IRS, Social Security Administration, Department of Veterans Affairs, and various state workforce agencies—use ID.me to confirm that the person logging in is who they claim to be. This added verification layer helps reduce fraud and protect sensitive personal and financial information.

Rather than creating separate identity verification processes for every agency, ID.me serves as a centralized identity credential. Once verified, you can use your ID.me login to access multiple participating platforms without repeating the full verification process each time.

You can learn more directly from the official website at https://www.id.me.

Why You Should Consider Having an ID.me Account

While not everyone will need an ID.me account immediately, there are several practical reasons business owners, high-income earners, and multigenerational families may want to proactively establish one.

1. Access to IRS and Tax-Related Services

Many IRS online services require identity verification through ID.me. This can include:

- Accessing tax transcripts

- Reviewing payment history

- Managing installment agreements

- Verifying certain tax credits

For business owners managing complex returns or overseeing multiple entities, streamlined access to IRS records can reduce administrative friction and improve coordination with your CPA or advisory team.

2. Social Security and Retirement Planning

As retirement planning becomes more digital, access to your Social Security account is increasingly important. ID.me may be used to verify identity for online Social Security services, including:

- Reviewing earnings history

- Estimating benefits

- Managing benefit claims

For individuals approaching retirement—or coordinating spousal or survivor benefits—secure digital access is an important planning tool.

3. State Workforce and Benefits Portals

Some state agencies use ID.me to verify eligibility for unemployment benefits and other state-administered programs. Even if you never expect to file a claim, having your identity verified in advance can simplify the process if unexpected circumstances arise.

4. Fraud Protection and Identity Security

Identity theft continues to be a concern for high-net-worth individuals and business owners. By using a verified digital identity platform, you may reduce the risk of unauthorized access to government accounts.

While no system eliminates risk entirely, multi-factor authentication and document-based identity verification add meaningful safeguards compared to basic username-and-password systems.

How to Set Up an ID.me Account

Setting up an ID.me account is generally straightforward, though the identity verification process requires attention to detail.

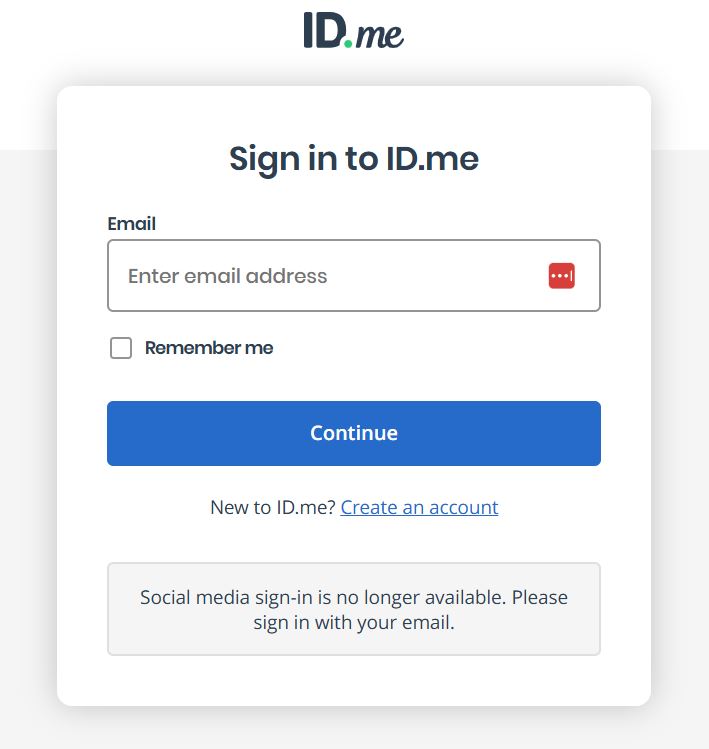

Step 1: Create an Account

- Visit https://www.id.me

- Select “Create an ID.me account”

- Enter your email address and create a strong password

You will receive a confirmation email to activate your account.

Step 2: Enable Multi-Factor Authentication (MFA)

ID.me requires multi-factor authentication for security. This typically involves:

- A code sent to your mobile phone

- An authenticator app

- A hardware security key (optional but more secure)

Multi-factor authentication is a best practice for protecting financial and personal data.

Step 3: Verify Your Identity

To complete identity verification, you may be asked to:

- Upload a government-issued ID (such as a driver’s license or passport)

- Take a live selfie or short video for facial recognition matching

- Provide your Social Security number

In some cases, additional documentation may be required. The process is designed to confirm that the ID belongs to you.

Step 4: Use Your Verified Account

Once verified, you can use your ID.me credentials to access participating agencies without repeating the full identity verification process each time.

Practical Considerations for Business Owners and Families

If you oversee multiple entities, trusts, or family financial structures, proactive digital organization matters. While ID.me is primarily an individual identity platform—not a business entity login—it can simplify personal access to key government services that intersect with broader financial planning.

Before uploading any personal documentation online, consider:

- Using a secure internet connection

- Confirming you are on the official website

- Storing login credentials securely

- Informing your spouse or trusted advisor of account access protocols in case of incapacity

Digital access is increasingly part of comprehensive financial organization, alongside estate planning documents, tax records, and account inventories.

An ID.me account is not an investment tool or financial product. It is a digital identity credential that can simplify access to important government services and help reduce friction in tax, retirement, and administrative matters.

For business owners and legacy-focused families, thoughtful digital organization—including secure identity verification—can support broader financial clarity and preparedness.

If you have questions about how digital access, tax coordination, or retirement account management fits into your overall planning strategy, the team at Omni 360 Advisors and Omni Legacy Law is available to provide general education and guidance tailored to your broader financial picture.

This blog was developed with the assistance of AI-based tools for research, drafting and editing support (Chat GPT), and reviewed by OMNI 360 personnel for accuracy and relevance.