Don’t Bet the Farm on Meme Stocks: Lessons from 2021’s Market Hype

August 13, 2025

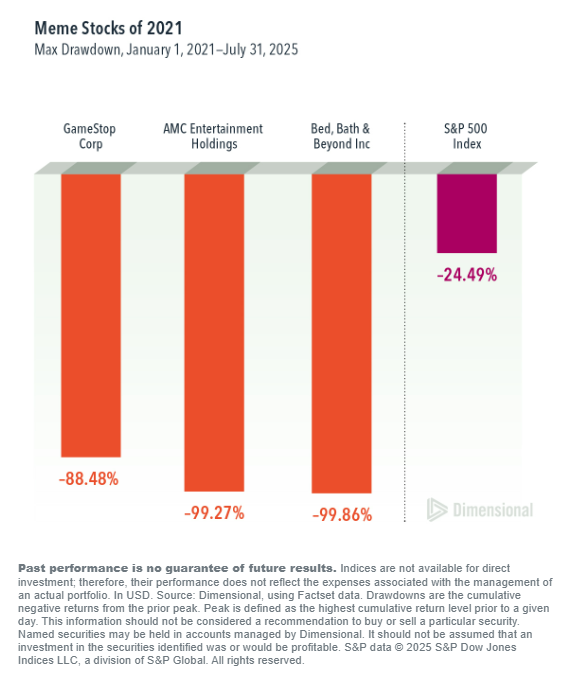

Meme stocks like GameStop, AMC, and Bed Bath & Beyond soared and then crashed, with drawdowns up to 99%. Here’s what investors can learn about speculation, diversification, and protecting wealth.

Don’t Bet the Farm on Meme Stocks: Lessons from 2021’s Market Hype

In early 2021, a wave of online enthusiasm turned a handful of struggling companies into household names — and stock market sensations. GameStop (GME), AMC Entertainment (AMC), and Bed Bath & Beyond (BBB) saw their share prices skyrocket thanks to viral momentum, coordinated buying, and a heavy dose of internet humor.

But just as quickly as they rose, these “meme stocks” came crashing back to earth. The recent Dimensional Fund Advisors analysis, “Donut Buy the Meme Hype” by Isabelle Williams, offers a sobering reminder: speculative surges rarely end well for long-term investors.

The Numbers Tell the Story

The chart above shows the maximum drawdowns for several well-known meme stocks from January 1, 2021, to July 31, 2025:

- GameStop Corp: –88.48%

- AMC Entertainment Holdings: –99.27%

- Bed Bath & Beyond Inc: –99.86%

- S&P 500 Index (for comparison): –24.49%

While the broad market experienced volatility, diversified investors were far better protected than those who concentrated their holdings in single speculative names.

Why Meme Stocks Struggle Over Time

Meme stock rallies are fueled by hype, not fundamentals. The social media buzz can create temporary spikes, but without strong earnings, competitive advantages, or sustainable growth strategies, these stocks often collapse once the excitement fades.

As Dimensional’s research points out, picking winners — meme stock or otherwise — is just another form of market timing. And history shows that even professional investors rarely beat the market consistently by trying to do this.

Diversification: The Antidote to FOMO

A well-diversified portfolio naturally includes small exposures to companies that may become the “next big thing.” But it also contains hundreds or thousands of other companies, cushioning the blow if a few high-profile names implode.

For business owners, high-net-worth families, and anyone navigating a post-liquidity event, concentrated bets on flashy investments can undermine years of disciplined wealth building. A balanced, global approach offers a far better chance of meeting long-term financial goals.

The Donut Analogy

As Williams cleverly puts it, meme stocks are like donuts — fine in moderation, but not the basis for a healthy diet. A few speculative positions might add some flavor to your portfolio, but they shouldn’t be the main course.

Final Takeaway

If 2021’s meme stock mania proved anything, it’s that hype-driven investments can burn bright — and burn out — fast. Protecting your wealth means resisting the urge to chase headlines and instead building a portfolio that can weather market storms.

Ready to align your investments with your long-term goals?

- Schedule a strategy meeting with Omni 360 Advisors to refine your portfolio.

- Book a legacy or estate plan review with Omni Legacy Law to safeguard your family’s future.

Chart and analysis source: “Donut Buy the Meme Hype” by Isabelle Williams, Dimensional Fund Advisors, 2025.

This blog was developed with the assistance of AI-based tools for research, drafting and editing support (Chat GPT), and reviewed by OMNI 360 personnel for accuracy and relevance.