How Strategic Financial Guidance Turns Market Volatility into Opportunity

June 16, 2025

Navigate market uncertainty with confidence. Learn how strategic financial advice can transform volatility into long-term growth opportunities.

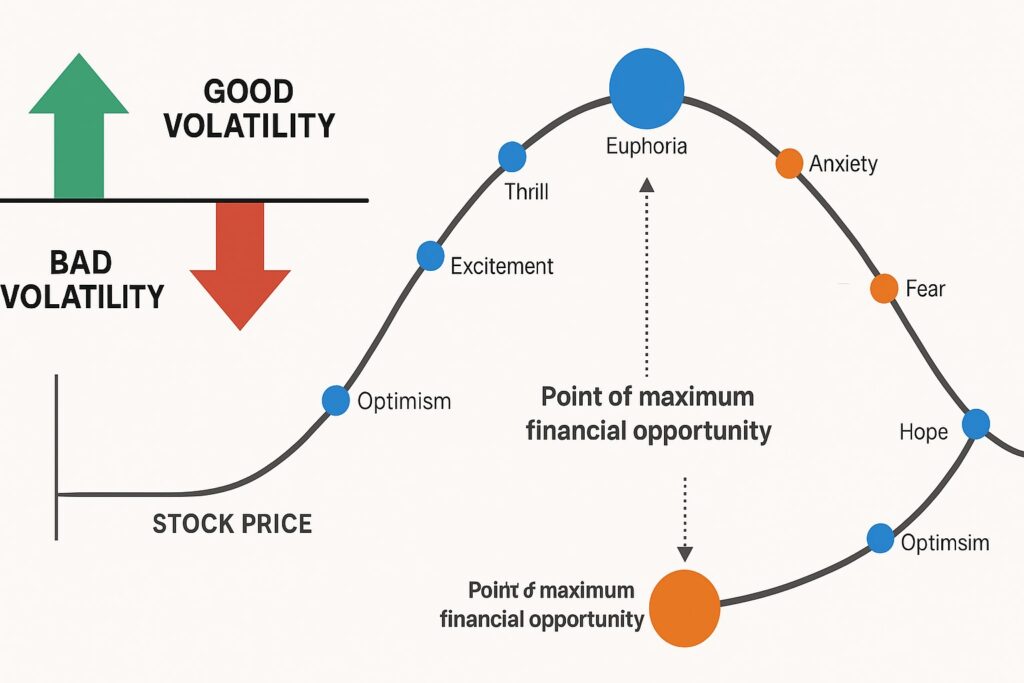

Market fluctuations often stir anxiety, even among experienced investors. For business owners, multigenerational families, and individuals navigating post-liquidity events, these moments can feel like a threat to financial stability. But volatility doesn’t have to mean vulnerability.

With experienced guidance, unpredictable markets can actually become a launchpad for smarter strategies. At Omni 360 Advisors, we believe volatility can help you reset, refocus, and seize opportunities that align with your vision.

Optimize Your Investment Strategy During Market Shifts

Instead of letting market drops shake your confidence, a seasoned advisor helps you pivot intelligently.

Harvesting Strategic Losses

When some investments dip, it might be wise to realize those losses to offset gains elsewhere. This isn’t just damage control—it’s a tactical tax strategy to improve long-term outcomes.

Rebalancing with Purpose

Sharp market swings often skew your portfolio’s intended allocation. A strategic rebalance can restore alignment with your risk tolerance and goals—potentially even capitalizing on undervalued sectors.

Smart Asset Placement

Where your assets are held matters as much as what you hold. Optimizing between taxable, tax-deferred, and tax-free accounts can significantly enhance after-tax returns.

Use Downturns to Your Tax Advantage

Choppy markets can create windows of opportunity for tax-savvy investors.

Converting to Roth at a Discount

Lower asset values mean converting traditional retirement funds to Roth IRAs may come with a smaller tax burden. Future gains then grow tax-free.

Front-Loading 401(k) Contributions

If cash flow allows, increasing contributions early in a down market means buying more shares at lower prices—boosting long-term compounding.

Capitalizing on Contributions to IRAs, HSAs, and 529 Plans

Market downturns can supercharge the growth potential of tax-advantaged accounts when timed correctly.

NUA Strategy Adjustments

For those with employer stock in retirement accounts, a drop in value may offer a unique opportunity to reset your cost basis and enhance future tax benefits.

Broader Planning Moves Beyond Investments

A holistic financial plan considers more than just market returns. Down markets can be a good time to act on other key strategies.

Gifting Low-Valued Assets

If you’re considering charitable or family gifts, transferring assets while values are low could remove future appreciation from your estate.

Tactical Dollar-Cost Averaging

You might already be investing in regular intervals—but temporarily increasing the pace during dips could add long-term value.

Reevaluate and Reaffirm Your Financial Plan

Volatility isn’t a signal to panic—it’s a cue to reassess.

Refresh Long-Term Financial Models

Your financial goals and market assumptions evolve. Revisiting your plan ensures your path still aligns with where you want to go.

Adjust Withdrawal Tactics Thoughtfully

If you’re drawing income, temporary changes in withdrawal strategy can preserve your portfolio and cushion against sequence risk.

The Upside of Uncertainty

Unpredictable markets test your resilience—but they also offer rare chances for strategic upgrades. With the right financial partner, you can navigate downturns with calm and emerge even stronger.

Book a strategy session with Omni 360 Advisors to explore how today’s volatility could strengthen your financial foundation for the future.

Source inspiration: Focus Partners article on market volatility: https://advisor.focuspartners.com/perspectives/how-a-financial-advisor-can-help-during-market-volatility/