What About Blended Families?

April 17, 2014

Planning for blended families presents particular challenges when it comes to ensuring your wishes are carried out. While every situation is unique, here are a few common problems and ways to address them.

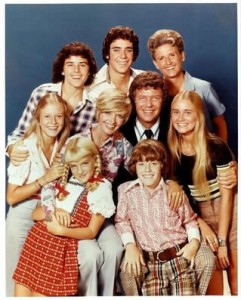

(Photo Credit: sitcomsonline.com)

Let’s say you want to disinherit your ex-spouse. At the very least, make sure you have replaced him or her as the named beneficiary of your retirement plans and other assets. You should also consider a Long-Term Discretionary Trust (LTD Trust) to administer your children’s inheritance, with a party of your choosing serving as trustee. In this way, even if your children reside with your ex-spouse, your trustee will control the inheritance through the LTD Trust and ensure it is used only for your children. Should one of your children predecease your ex-spouse, the inheritance would remain

in your LTD Trust for your grandchildren and, if there are none, for your surviving children or other beneficiaries of your own choosing.

Another useful trust is called a Qualified Terminable Interest Property Trust (QTIP Trust). It can protect your new spouse by providing income and even principal for life. It can also protect your new spouse’s inheritance in the event of a subsequent remarriage and divorce. And, upon the death of your new spouse, the QTIP Trust assets may pass to the LTD Trust you established for your own children.

To learn more about the unique planning problems associated with blended families, and how we can help address your particular concerns and goals, please contact us for a consultation.