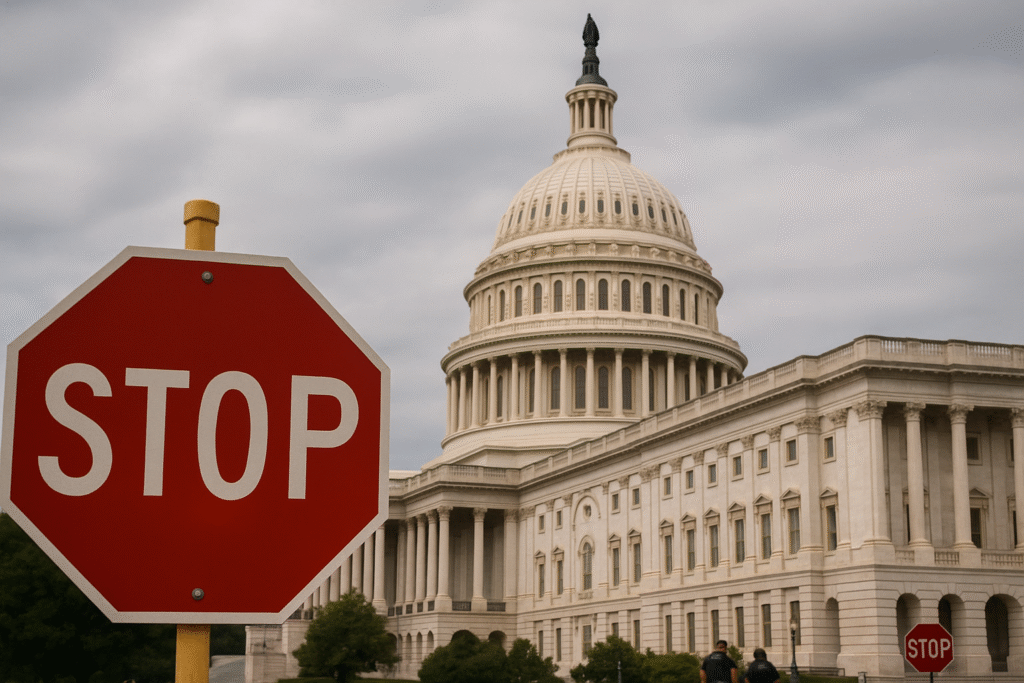

Why a Government Shutdown Isn’t Necessarily a Market Disaster

October 15, 2025

Despite the noise, U.S. stock markets have historically held their own during government shutdowns. Here’s what business owners, executives, and legacy-focused families need to know—and how to stay aligned through volatility.

Why a Government Shutdown May Not Sink Your Portfolio

When Congress fails to reach agreement on federal funding, parts of the U.S. government shut down. That can mean furloughed employees, suspended administrative work, and uncertainty. But does it spell disaster for the stock market?

While unsettling, a shutdown isn’t necessarily a death knell for investments. According to historical data, the U.S. market ended higher in three of the prolonged shutdowns and was flat in the remaining longer shutdowns. In short: storms cause noise, not always damage.

Below, we dig into the details and, more importantly, draw lessons you can use as a business owner, executive, or multigenerational family stewarding wealth.

What the Data Shows: Markets Through Past Shutdowns

- Since 1981, there have been 11 U.S. government shutdowns.

- Four of them lasted at least five days.

- Over those extended shutdowns, the U.S. broader market (as measured by relevant indices) ended higher in three episodes and flat in one.

- That suggests that, historically, a funding stoppage may be a “nuisance” — annoying, but not necessarily harmful to long‑term equity performance.

Yes, this is based on past results. That means caution is warranted. Market conditions differ, and past performance is no guarantee of future results. Nonetheless, the evidence argues against overreacting.

What This Means for You: Strategic Lessons

1. Avoid knee‑jerk reactions

It’s tempting during headline news to pull money out or rotate into “safer” assets. But historical behavior suggests markets often absorb overnight political shocks. If your investments are aligned with your long-term goals, reacting emotionally may hurt more than help.

2. Stick to your plan

Volatility and surprises are part of markets. A thoughtfully built portfolio with asset allocation, risk buffers, and diversification is better equipped to weather short-term policy noise.

3. Use the moment to revisit your resilience

A shutdown is an opportunity to stress-test your plan. What assumptions might change (e.g. interest rates, credit markets, consumer sentiment)? How would your core holdings behave under various scenarios?

4. Keep liquidity and execution in view

In extreme policy paralysis, some codes or agencies might slow down. If you’re planning equity sales, acquisitions, or large redeployments during uncertain windows, confirm that operational and regulatory pathways remain open.

5. Maintain a legacy and continuity mindset

Especially for families or business owners, a shutdown is a reminder that risks come from many quarters—regulatory, political, fiscal. Embedding flexibility in governance, estate design, and succession plans helps you endure periods of uncertainty.

Final Thoughts & Invitation

A government shutdown may rattle headlines, but historical evidence suggests it doesn’t have to rattle well‑constructed portfolios. The key is resisting the emotional impulse to over‑trade, staying anchored to your long‑term goals, and using volatility as a moment to reinforce resilience, not rethink it.

If you’d like to review whether your investment strategy is truly shutdown‑resilient—or ensure your legacy and estate plan can outlast political cycles—let’s talk.

Ready to take the next step?

- Schedule a strategy meeting with Omni 360 Advisors

- Or book a legacy or estate plan review with Omni Legacy Law

As always, your financial life deserves more than reaction—it deserves intention, foresight, and architecture built for the long game.

This blog was developed with the assistance of AI-based tools for research, drafting and editing support (Chat GPT), and reviewed by OMNI 360 personnel for accuracy and relevance.