Keep Business Assets Separate from Personal Assets

January 2, 2017

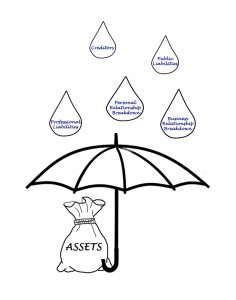

In the process of asset protection planning, there are many different steps you need to take. You need to begin by separating your business assets from your personal assets. In addition, as you develop income diversity it is equally more important to consider business and personal assets as separate. This helps to protect these assets in different situations. For example, if you become the subject of a lawsuit, your creditors could tap into the businesses that you have worked so hard to build. Ensure that your business structures have been developed properly to protect any personal assets.

Making use of trusts is one common way that you can engage in successful asset protection planning situations. An attorney who specializes in the process of asset protection can help you identify the right strategies and documents to assist you with this goal. Getting assistance in managing your assets can be extremely important in the protection process. Having tight control over all of your assets at any time means that someone from the outside can successfully argue that you are truly in control of all the assets and that they are yours rather than being placed inside a trust and having the trust maintain the ownership.

It is very important to have a barrier between you and your assets for this purpose. Unfortunately, there are many different risks that could jeopardize the control and future of your assets. Failing to take action until it’s too late could mean losing access to these assets and generating numerous unnecessary problems. Consulting with an experienced asset protection planning attorney could help.