Fast Facts: Inheriting Books

November 4, 2014

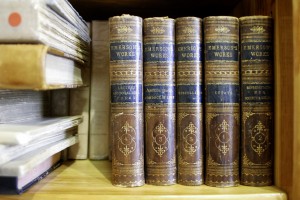

When a loved one passes away, there are many valuables or assets that might be specially reference in the will or other estate planning documents, but inheriting a library can raise a lot of questions for you. If you’re not a book collector yourself, it can be confusing to determine what books are rare or not and just how much time you should spend on figuring out what to do with the books.

If you make a bulk donation, though, you might miss out on some rare library gem that you’d like to keep in the family or sell. If you think there are rare books in the collection you’ve inherited, it could be worth the time to identify those special books and make your own decisions about how to handle them.

Thankfully, there are several sites that can make your search easier. You can begin by sorting the books you know you want to keep or give away and make a special pile of those you want to research further. This will help you make the most of your time.

The following sites can be helpful when you’re searching for book values. To make sure you’re accessing the right information, always use the ISBN as opposed to the title or author so that you are comparing apples to apples.

- Abebooks.com

- AddALL.com

- bookpricescurrent.com

If you think there are numerous titles that you can’t handle, contact a rare books specialist to help you determine the value of what you’re looking at. An experienced dealer can also clue you in to factors like possible damage or covers that could alter the actual value of the item.

If you’ve got rare books in your own collection, consider listing them for your estate plan. It will make life easier on your heirs in the event that you have a large library. To learn more about estate planning for unique assets, contact our office today at info@lawesq.net