Millennials Share Their Unique Retirement Planning Interests

April 13, 2017

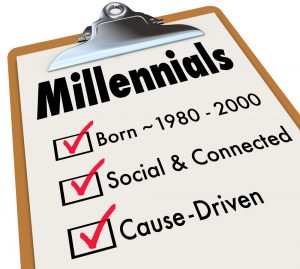

Research shows that Generation Y hopes to plan for retirement online as well as on mobile and they would prefer to do so with all the help they can get. This indicates an important societal shift that could occur as it relates to retirement planning and estate planning.

Although millennials are typically defined as a generation focused on individuality, many of them recognize that they need assistance managing their finances and planning ahead for retirement. Most millennials are asking for their employer’s help, for example, in selecting the right investments.

Up to 69% of millennials in fact stated in a recent study that they would like to outsource the management of their retirement portfolio. This provides an important connection to the estate planning process as well. Since more millennials are interested in handling things online and easily, it’s an important conversation that needs to incorporate estate planning as well.

While millennials might often fall into the myth of thinking that they do not need estate planning services since they are relatively young and healthy, that is incorrect. Important documents like a power of attorney can help empower millennials to make critical decisions.