Why is Business Succession Planning an Ounce of Prevention?

November 23, 2015

A person given a one-third chance of survival in life is alerted to this fact. But in many cases a person whose business faces the same chances will prefer to deal with the matter later on down the road.

The key in this situation is a balance between business Goals and family relationships as well as balancing emotion and logic.

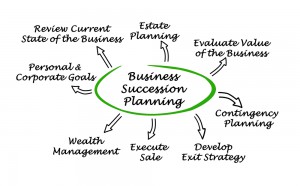

In the process of conducting business succession planning you should identify the objective first. Is it to sell the business? Is it to give the business to someone? When will this take place? And who will be the key parties involved. After this initial need has been accomplished, it is time to consider the financial need. Does the retiree need business proceeds on which to live and if so, how much and how will these be paid out? And finally, key employees should be kept for the purposes of continuity and employment agreements can aid in this situation, building incentives and using non-compete agreements for structure.