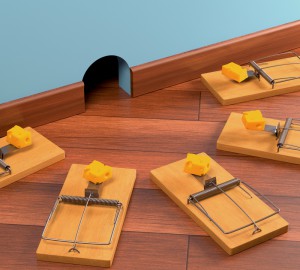

5 Common Estate Traps To Be Aware Of

June 26, 2015

Leaving behind a legacy after you pass away requires perceiving and planning to avoid several common pitfalls. Make sure you’ve completed the estate planning process at least once in a comprehensive manner, with yearly check-ins scheduled. Watch out for these common issues:

- Failing to include contingency beneficiaries on a retirement account

- Not planning for the potential of your spouse remarrying someone new, and thus making that new spouse eligible for money you had intended to set aside for children

- Failing to account for the impact of aging parents

- Failing to think about incapacity and what your plans would be if something left you with a disability

- Not thinking carefully enough about trustee appointments or power of attorney selections

Although these might seem minor, they can have major implications for your estate and for the loved ones you leave behind. You can prevent mistakes and mismanagement by doing the work in advance and reviewing it on a regular basis.

Estate planning is certainly more complex than these basic five issues, but getting your plan in working order can be as simple as fixing the issues related to these concerns. Contact an estate planning attorney to learn more. Get our help by contacting info@lawesq.net.