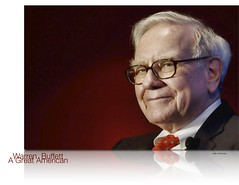

Estate Planning: Lessons from Warren Buffett

June 12, 2013

One of the most interesting parts of Warren Buffett’s estate plan is how he designed it to leave his children just enough so that they can do anything they like, while also not leaving them so much that they never have to do anything. As a recent article explains, many people would like to replicate this part of his estate plan.

Many parents wonder how much they can leave their children, before their children become lazy spendthrifts. However, simply leaving money to children may not be the whole problem. As Warren Buffett recently explained, “I think that more of our kids are ruined by the behavior of their parents than by the amount of the inheritance.” Parents who do not want their children to grow up as spoiled brats should focus on the environment that they raise their children in, rather than the inheritance they will give them.

Buffett also believes that it is “crazy” for your children to read your will for the first time after you have died. This is because communication is key to a smooth estate transition. If you discuss your will with your children before your passing, you stand a far better chance of avoiding disaster after your death. Although this conversation may be awkward, it is often necessary to outline your intentions and reasoning.