Materials You Should Have Before Applying for Medicaid

January 13, 2016

After discussing your Medicaid application and preparing for it in advance with your elder law attorney, there may be an appropriate time you should begin the application process. There are several things you should know about the Medicaid application process in order to set yourself up for success.

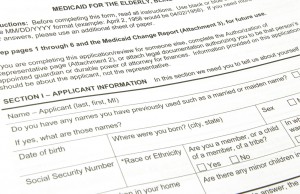

One of the things that surprises most elderly individuals and their caregivers is the amount of documentation required for a Medicaid application. The more prepared you are, the easier it will be to submit this information and in the proper order so that you do not have any unnecessary delays associated with the application. The following items should be included with your application.

- Birth certificate

- Marriage information

- Social security award letter or social security card

- Information about all loans owed

- A copy of a residential rental agreement (if applicable)

- Health insurance premiums and identity cards

- All unpaid medical bills

- Alimony statements or child support statements

- Any cars owned

- Pay stubs over the last six weeks

- details of any pension plans where benefits are being received

- Copies of tax return for the last five years

- All life insurance statements and policies including any cash value accumulated within these policies

As you can see, the Medicaid application process can be quite extensive and may be a bit overwhelming. Planning in advance of options you have with your assets as well as qualifying for Medicaid can be an important first step to discuss with an elder law attorney.